Group Size

?

1.) Small group (teams of 4-6)

2.) Individual Task

3.) Large Group

4.) Any

Any

Learning Environment

?

1.) Lecture Theatre

2.) Presentation Space

3.) Carousel Tables (small working group)

4.) Any

5.) Outside

6.) Special

Any

QAA Enterprise Theme(s)

?

1.) Creativity and Innovation

2.) Opportunity recognition, creation and evaluation

3.) Decision making supported by critical analysis and judgement

4.) Implementation of ideas through leadership and management

5.) Reflection and Action

6.) Interpersonal Skills

7.) Communication and Strategy

3Decision making supported by critical analysis and judgement

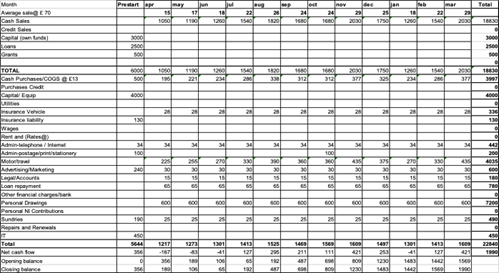

A workshop designed to support the production of financial elements and pages of a business plan, helping understand and create narrative around pricing and costing. Leading to the production of a cash flow forecast and profit and loss. This workshop breaks down and simplifies how to work out the break even and supports the evaluation of risk prior to starting a venture. The workshop is designed for both curriculum and for start up.

It is important that at the start of the workshop the learners are thinking around a business model, although the workshop is a stand alone session, it is usually part of a series of workshops designed to be used once the learner has a business idea, or has attended the initial business planning workshops.

The session can be delivered as a 2 hour session but is enhanced by the exercises being 20 mins each which turns the workshop into 3 hours.

Exercises are within the PP.

A 2 hour workshop with 3 separate exercises delivered by PowerPoint.

Pictures: